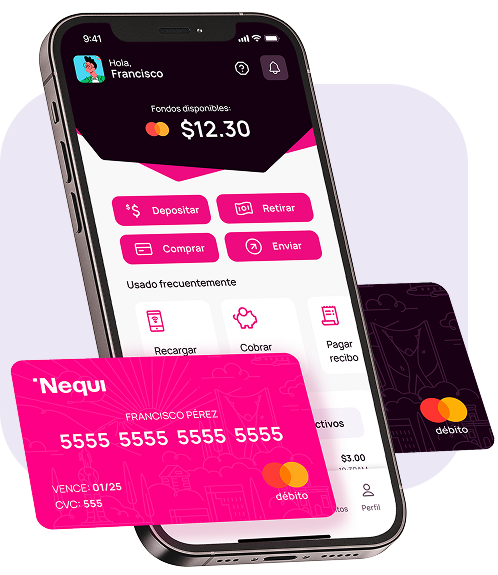

Nequi Expands to Central America: Digital Banking Innovation Arrives in El Salvador and Guatemala

Nequi expands to El Salvador and Guatemala, bringing Colombia’s digital banking expertise and over 30 services to Central America, empowering users with financial inclusion, credit, and digital tools.

Nequi, the digital platform of Grupo Cibest (formerly Grupo Bancolombia), is expanding its footprint beyond Colombia, launching services in El Salvador and Guatemala through Bancoagrícola and Bam, two banking institutions operating in the region.

This expansion leverages the expertise Nequi has developed in Colombia, where it has become a benchmark in financial inclusion, serving over 26 million clients and processing more than 70 million transactions in a single day.

A Comprehensive Digital Ecosystem

According to Andrés Vásquez, Nequi’s General Manager in Colombia, the platform offers more than basic money transfers, providing over 30 financial and non-financial services with ease and security.

“Nequi is more than sending money; it’s an ecosystem of possibilities: paying phone bills and utilities, topping up transit cards, making investments through our partnership with Trii, receiving international income via PayPal or remittances, accessing music and entertainment platforms, buying bus tickets, or obtaining insurance,” he explained.

Although Nequi is entering Central America, Grupo Cibest emphasized that the brand operates under the banking license of each local entity and does not hold equity in these institutions.

“These learnings will allow us to implement best practices and deliver a solution aligned with the needs of Salvadoran and Guatemalan markets,” stated Cibest executives.

Credit as a Tool for Inclusion

Nequi has also focused on small-scale credit since 2019, promoting responsible and accessible loans. In the second quarter of 2025, the platform disbursed over COP 1.1 trillion through more than 407,000 loans, with an average amount of COP 2.3 million per user.

Vásquez highlighted that 68% of these users had no prior credit experience, demonstrating Nequi’s role in reducing financial gaps and offering alternatives to informal lending methods such as “gota a gota.”

Education and Financial Empowerment

Beyond transactions and credit, Nequi aims to be a fully integrated platform that supports users in achieving their financial goals. Education is a core pillar, with services and products complemented by content strategies providing practical tools on saving, responsible money management, and current financial insights, according to Grupo Cibest.

Nequi’s entry into El Salvador and Guatemala marks a strategic step in expanding digital banking access in Central America, delivering a familiar, reliable, and innovative financial ecosystem inspired by its success in Colombia.